The coffee market remains fickle

Image: J Poole

As we head into coffee year 2023/2024, weather risks remain high for robusta coffee as El Niño’s effects become more apparent. Costs are still up, and although there were minimal changes to production in the final quarter of CY 2022/2023, there were noteworthy changes in demand. In an exclusive article to T&CTJ, Carlos Mera, head of the agri-commodities markets at Rabobank’s RaboResearch Global Economics & Markets division, reviews the recently closed CY 22/23 and assesses CY 23/24, which began 1 October. By Carlos Mera

Production changes

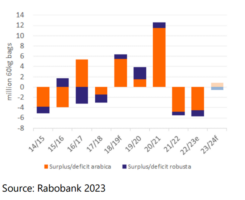

Over the last three months there have not been many changes to production, but significant changes to demand. Rabobank estimates coffee production at 163.7m bags in 2022/23 and at 172.6m bags in 2023/24. The global deficit in 2022/23 is now estimated at -5.7m bags (a reduction of 0.7m bags, mainly due to demand dropping more than production), while a neutral balance is projected for 2023/24, with a surplus in arabicas and a deficit in robustas.

Global coffee balance. Image: Rabobank

Brazil’s export pace has been accelerating, especially in conillons. While green arabica exports were expected to go up in August given that the early harvest was ready to be exported, the strength of green conillon exports was probably more surprising to the market: July exports were up +109 percent vs June, and preliminary August exports remained strong. In our view, this was to be expected given two consecutive large conillon crops and the increased domestic availability of arabicas in the current harvest. The current local arbitrage in Brazil simply does not incentivise maximising the conillon share of demand going forward, freeing up more conillon for the international market. It is a delicate time to make output predictions in Brazil for next year, but an increase in production is expected.

We also expect some production recovery in Colombia 2023/24, but it will probably be gradual. Cost of production has been increasing and farmers are getting half of what they were receiving a year ago (in COP). The weather in 2023 has improved but it has not been ideal, leading to an initial estimate of 12.5m bags in 2023/24 (following around 10.5m bags in 2022/23). Honduran coffee sales are 14 percent higher so far this season YoY, which means that even our previously optimistic prediction of a 10 percent increase in production in the last harvest (2022/23) is proving to be falling short, and we are increasing our estimate slightly. Exports from other countries in Central America are significantly less optimistic. It is very early to make predictions for Central America in 2023/24, but the end of La Niña is usually favourable.

Image: Vanessa L Facenda

The robusta rally was quashed by the collapse in arabica prices since June. However, there are still concerns about the availability of robusta. El Niño-related dryness is becoming more frequent in parts of Southeast Asia, including some areas of Indonesia and Vietnam, Laos, much of Thailand and parts of India. In key producer Vietnam, the main robusta regions still seem to be getting decent rainfall, but the arabica areas in the north look dry. Our expectation for Vietnam 2023/24 has recently been marginally revised lower to 29m bags of total coffee (similar to 2022/23). We have been making small downward adjustments to production estimates across the region.

Coffee demand

Import demand figures were very gloomy throughout 1H 2023. In the second quarter of 2023, net imports into the European Union + United Kingdom collapsed 13.4 percent versus a year ago, while in the United States they were down 9.6 percent. Japan’s coffee disappearance in the quarter was largely unchanged YoY. We can track other 24 non-producing countries, where the drop in net imports in Q2 was 2.9 percent YoY. Globally, the drop for Q2 was 9.4 percent YoY. This is worse than a very poor Q1, and it is in fact, the largest drop we can track in our data going back to 2008. In the 12 months to June 2023, the annual drop in all non-producing countries that we can track was 2.2 percent.

As we have been pointing out for most of last year, the rise in interest rates should have led to a decline in inventories along the pipeline. Roasters and traders also feel more confident that container shipping is working much more normally, so there is no need to keep stocks ‘just in case’. However, these results are worse than expected and lead to a reduction in global demand growth to virtually zero percent in non-producing countries, while producing country demand might still grow at over one percent.

The rather low arbitrage (at around USD $0.40 at the time of writing) should lead to a comeback in arabica demand. This is particularly the case in producing countries (and Brazil in particular), where there is usually a surplus of low quality arabica grades as subproduct of the export business.

Image: Vanessa L Facenda

Price drivers

An expected recovery in both Brazil and Colombia in 2023/24, combined with weak demand, continues to put downward pressure on the market in the absence of more adverse weather or news. This is exacerbated by the prospect of a recession in the EU. Yet we are not far from cost of production in a number of arabica-producing countries. The rainfall pattern in the Brazilian arabica belt will, as usual, be the focus of the market over September and October.

If the idea of a bumper arabica crop in Brazil in the coming year is reinforced not only by good rainfall, but also by good flowering and actual fixing of flowers and pinheads through November, then there is a chance that speculators will start selling arabica futures with more conviction and prices could move lower and closer or even below cost of production, which is roughly estimated at USc 140/lb. But in the short term, any variation in the weather pattern in Brazil (weather hardly ever is perfect) and a very probable improvement in import demand in Q3 are likely to offer support to prices.

Meanwhile, speculators in the robusta market will continue to focus on potential El Niño-related effects. As El Niño is expected to last until at least the end of Q1 2023, speculators will likely stick around for the remainder of the year. Concerns over the EU Deforestation Regulation could also mean that some robusta produced before mid-2023 is carried into 2025 (at a tremendous cost). On the arabica front, this is less likely, as arabicas would lose more value over time.

- Within RaboResearch Global Economics & Markets, Carlos Mera serves as the head of the agri-commodities markets team in London. Previously, Mera worked at Rabobank as a senior commodities analyst with a focus on coffee and cocoa. Prior to joining Rabobank, he worked at Neumann Kaffee Group where he conducted coffee market research for more than seven years. Mera holds a Master of Finance from the London School of Economics and a Bachelor of Economics from the University of Buenos Aires. He may be reached at: [email protected]. With over 140 analysts around the globe, RaboResearch covers topics related to economics, global financial markets as well food and agribusiness. For more information on RaboResearch, visit: rabobank.com/en/research.